Key performance results for 2023

| Indicator |

2022 |

2023 |

| Production indicators: |

| Passenger traffic, million |

7.4 |

8.1 |

| Aircraft load factor, % |

83 |

83 |

| On-time flight performance indicator, % |

74 |

79 |

| Financial indicators, KZT billion: |

| Revenue |

478.0 |

535.2 |

| Dividends |

7.5 |

0 |

| Net profit |

37.6 |

30.7 |

| Operating income |

70.1 |

61.3 |

| Sustainability indicators: |

| GHG emission intensity (tons of CO2 per seat-kilometer) |

0.064 |

0.063 |

| Volume of disposed waste, tons |

8.15 |

11.79 |

| Accidents |

17 |

29 |

| Fatal accidents |

0 |

0 |

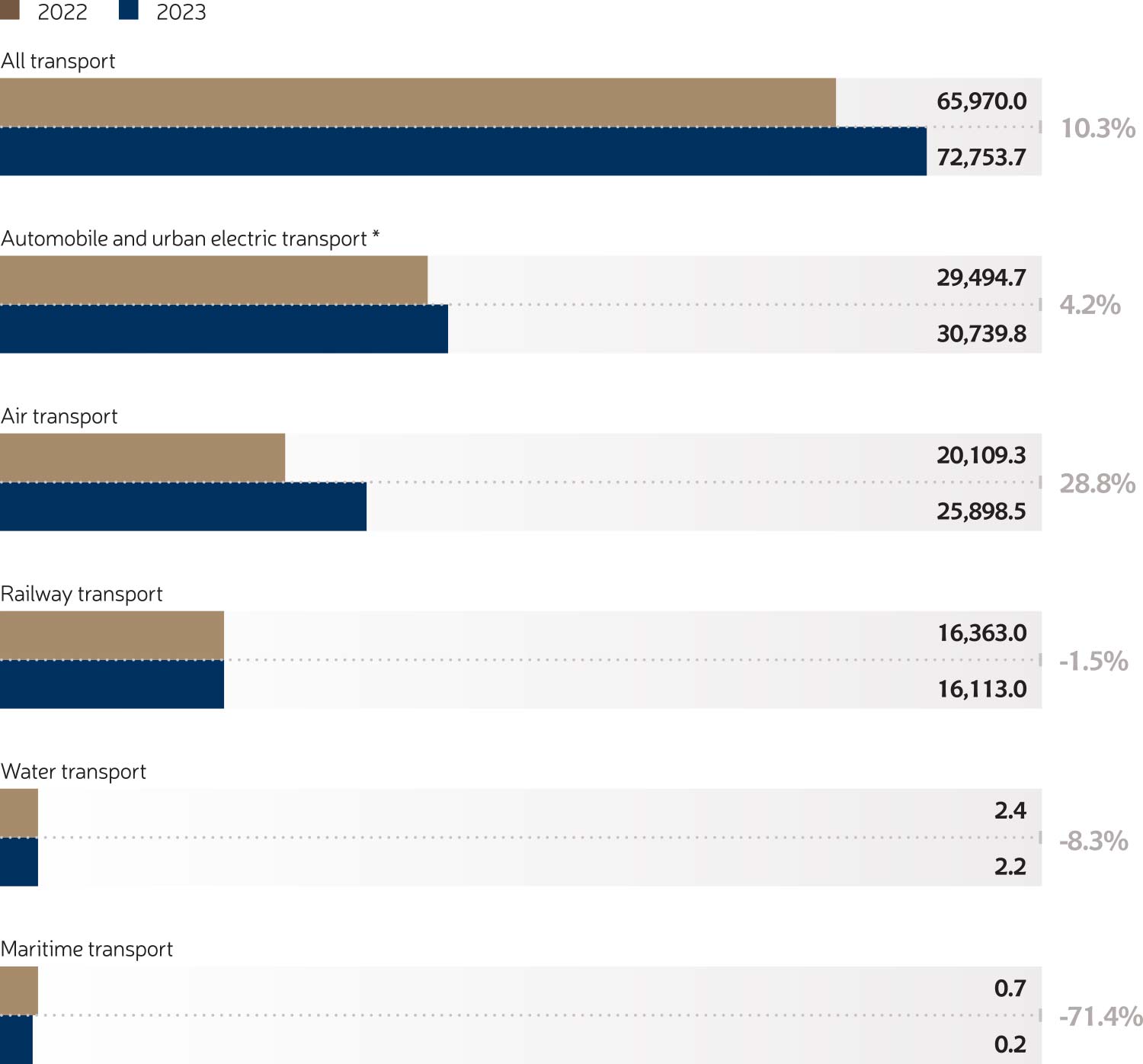

Market Overview

Air transportation of passengers and cargo is closely linked to global economic development.

In 2023, the international air

transport network recovered to

89.5%

Recent restrictions on flights to and from Russia have had a negative impact, but the opening of the market in China has already shown positive effects. In 2023, the international air transport network recovered to 89.5% of its pre-pandemic level, and domestic transport to 97.5%, which is 12 percentage points higher than in 202218.

The situation is expected to continue improving in 2024.

Leisure travel is more closely tied to seasonality, particularly evident in Europe, which was unprepared for the huge number of passengers wanting to fly in the summer of 2023. In 2019, a 50% increase in demand was anticipated for the vacation season. The increase to 65% in 2023 led to delays and dissatisfaction among both passengers and staff. However, in North America, the impact was not as severe, as flights to resort destinations at short distances are operated year-round.

The solution to this problem should be flexibility and adaptation to increased seasonal fluctuations. Some airlines have already taken steps to shift crew training and annual employee vacations to off-peak periods. Maintenance programs have been adjusted accordingly. Wider use of automated processes, such as self-service passenger check-in, helps to reduce the load. On the other hand, identifying and increasing the number of destinations for beach holidays in winter, as well as seeking commercial and international contracts from the MICE category (meetings, incentives, conferences, and exhibitions), can increase revenues during low-demand periods.

18 Source: Global Outlook for Air Transport), IATA, December 2023.

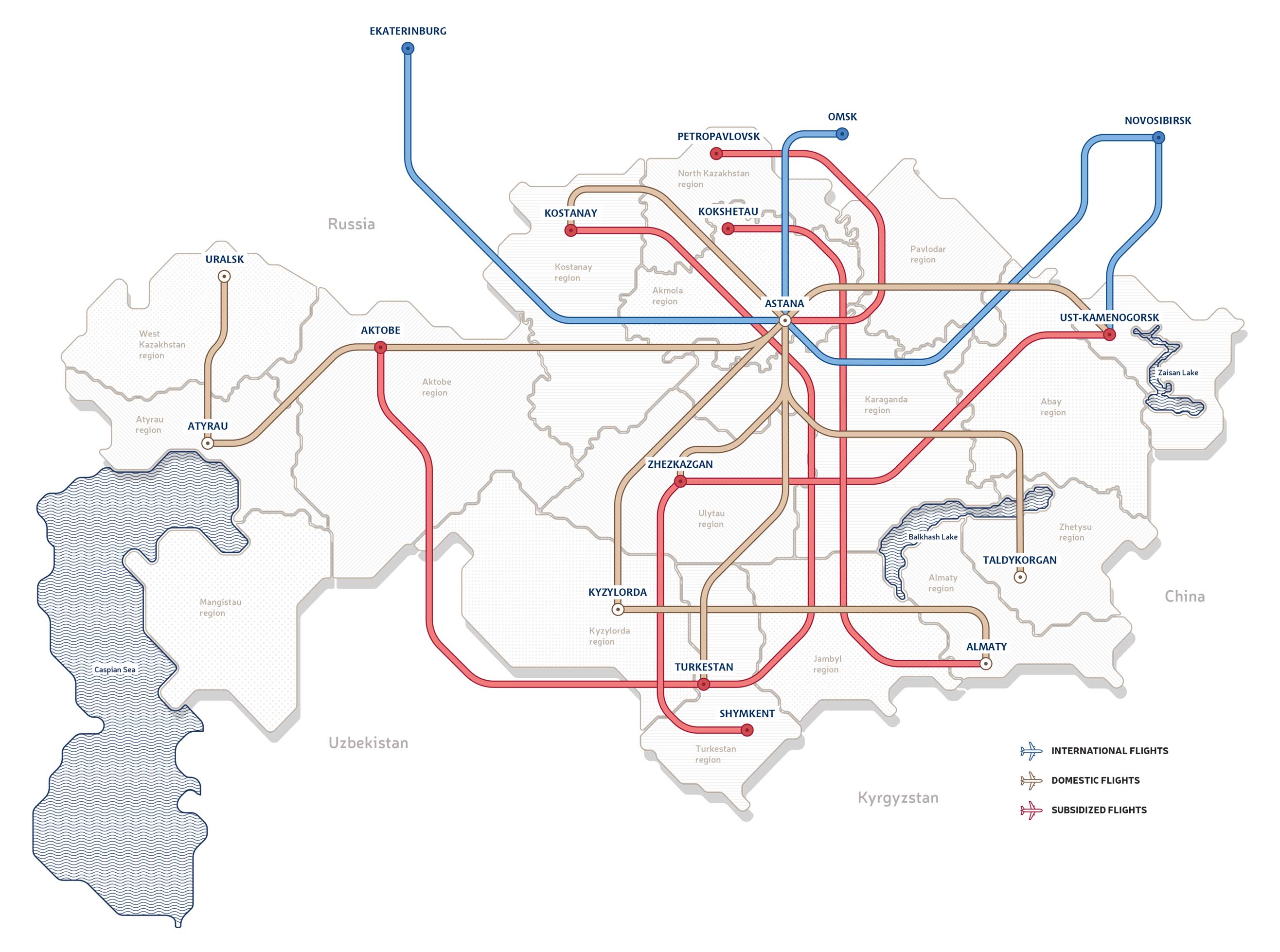

Kazakhstan aviation market

Kazakhstan has 20 airports, 18 of which are open for international commercial flights. The airports are either state or privately owned, except for the Aktobe International Airport, which is owned by a public-private partnership.

According to the Aviation Administration of Kazakhstan (AAK), the civil aircraft registry of Kazakhstan has 920 units, 17% of which are airliners.

The number of Kazakhstani operators registered with AAK is 53 in 2023. Air Astana is one of seven airlines allowed to fly to EU countries. The other operators are Comlux, Prime Aviation, FlyJet.kz, KazAirJet, Jupiter Jet and SCAT. Six airlines operate domestic flights: Air Astana, FlyArystan, SCAT, Qazaq Air, Southern Sky and Zhetysu.

Kazakhstan continued to develop its air transport capabilities in 2023. The Civil Aviation Committee is reforming its sector, intending to adopt the European management model within 2-3 years. As part of this effort, AAK is responsible for the regulatory oversight functions of the industry, improving efficiency, and preventing corruption.

The Government of Kazakhstan intends to increase the number of international flights and continues to implement the open sky policy to attract new foreign carriers. Specifically, flights to Doha (Qatar), Ankara (Turkey), Medina (Saudi Arabia), Baku (Azerbaijan), and Dushanbe (Tajikistan) were added in the spring and summer. Additionally, the number of flights from Astana, Almaty, Aktobe, Turkistan, and Atyrau to Istanbul will be increased, as well as from Astana and Almaty to Antalya, and from Almaty to Baku, Tbilisi, Phuket, and Malé.

Air Astana launched flights to Tel Aviv twice a week in September 2023, but was forced to discontinue them a month after opening due to the conflict in the region.

Domestic market

The launch of FlyArystan has had a significant impact on Kazakhstan's domestic market (before, during, and after the pandemic) and has contributed to the rapid recovery of the overall air transport market. Today, Kazakhstan's market is the fastest-growing domestic market in the world.

Over the past five years, FlyArystan has driven the majority of domestic transport growth, accounting for 37% of domestic flights in Kazakhstan in 2023. Together with Air Astana's 30% share, the Group represents 67% of the entire domestic market.

Since the inception of FlyArystan, both of Kazakhstan’s major airports—in Almaty (the largest airport) and Astana—have seen an increase in domestic passengers, totaling about 70%. While Astana Airport accounted for about 5% of this volume, the number of domestic passengers at Almaty Airport grew from 2.8 million in 2018 to more than 5 million in 2023.

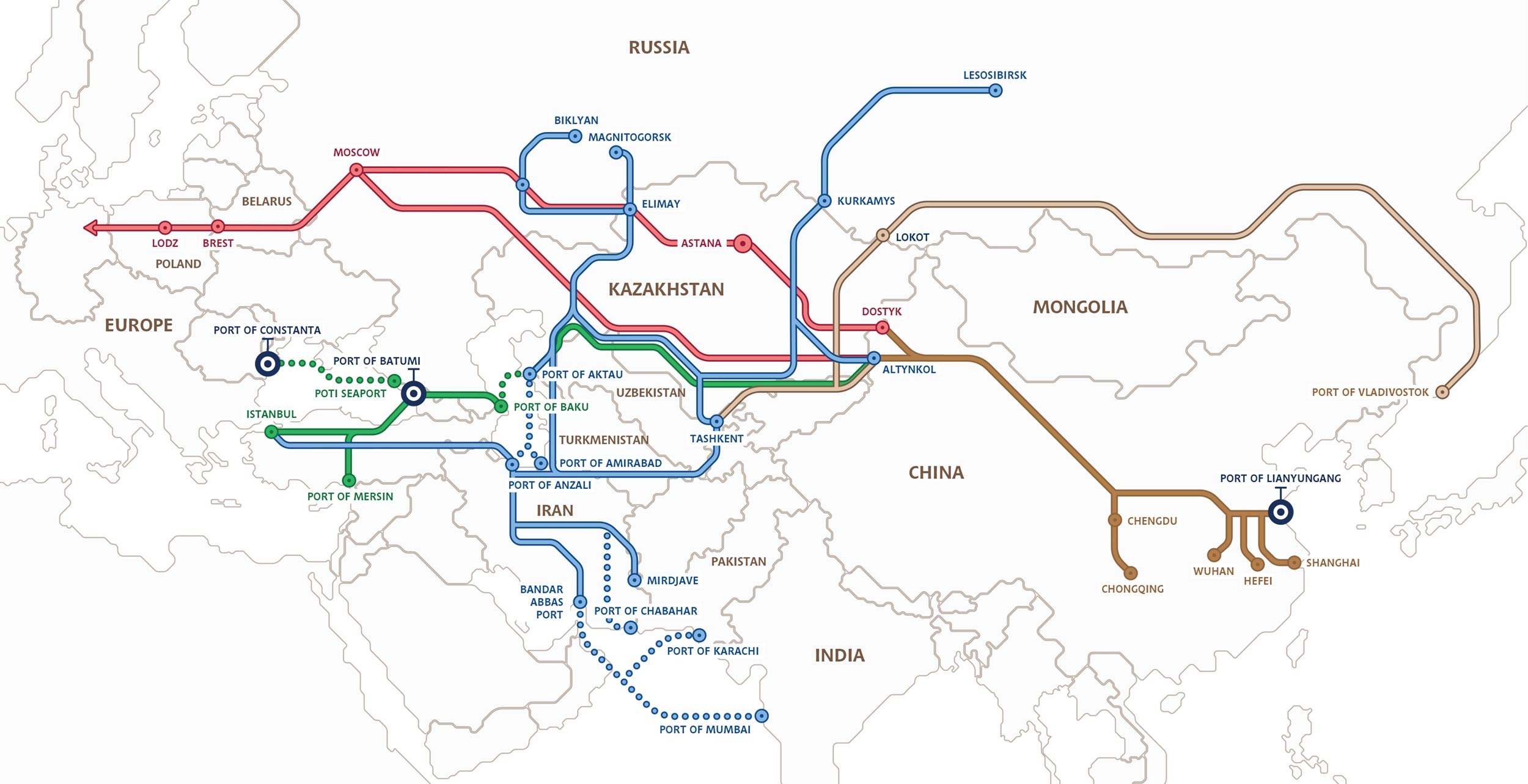

Trucking. Global overview

The global decline in demand for cargo air transport, which began in 2022, continued for most of 2023.

The overall cargo capacity, measured in available ton-kilometers, increased by

11.3%

The problems remained largely the same: a downturn in the global economy and trade, the geopolitical situation worldwide, persistently high inflation in key markets, and increased global oil prices. Tensions in the Red Sea region added to these issues in the fourth quarter, the full impact of which has yet to manifest.

One of the latest effects of the pandemic in 2023 was the gradual discontinuation of passenger aircraft temporarily converted for cargo transport (so-called "preighters"), as they were reconfigured and returned to regular passenger service. Global cargo capacity significantly increased over the past two years as international passenger flights resumed and schedules expanded exponentially, opening opportunities for cargo transport in the belly-hold of passenger aircraft. The overall cargo capacity, measured in available ton-kilometers (hereinafter — ATKs), increased by 11.3% compared to 2022 and grew by 2.5% compared to pre-pandemic levels. Belly cargo in passenger aircraft accounted for 49% of the ATKs, a significant increase from 20% in 2020. This mode of transport continues to capture market share from dedicated freighter aircraft.

This substantial increase in belly-hold capacity negatively impacted cargo load factors (CLFs), affecting cargo revenues and airline profitability. Decreasing throughout the year, the global average CLF ended the year at 44%, although it reached 49.9% on international routes, 0.8% higher than in 2019. As an indicator of the balance between supply and demand in the industry, it is expected to stabilize after the normalization of passenger and cargo volumes to pre-pandemic levels.

Air Astana Group’s cargo turnover growth in 2023 primarily occurred on routes from China, Korea, and the UAE to Kazakhstan. The growth matched the increase in capacities deployed in 2023. Cargo volumes from Turkey were affected by the slowdown in economic growth and the limited cargo capacity of narrow-body aircraft.

Aircraft fleet

Air Astana's plans for future capacity and passenger comfort are closely linked to the expansion and simplification of a fuel-efficient and environmentally friendly aircraft fleet, addressing all three strategic directions: growth, efficiency, and high standards.

In 2023, the Group acquired the latest aircraft, an Airbus A321LR in October and an Airbus A320neo in November. As of December 31, 2023, the Group's aircraft fleet increased to 49 aircraft (43 in 2022), including 41 narrow-body Airbus A320 family aircraft, 5 narrow-body Embraer E190-E2 aircraft, and 3 wide-body Boeing 767 aircraft (under a single Air Operator Certificate (AOC), 31 aircraft are operated by Air Astana and 18 by FlyArystan).

The new, more modern, and eco-friendly aircraft reduce operational costs and environmental impact. For example, the Airbus A320neo family can provide up to 20% reduction in fuel consumption, a 20% reduction in CO2 emissions (NOx), and a 50% reduction in noise levels compared to the previous generation A320ceo aircraft. Considering the fleet additions in recent years and in 2023, the average age of the Group's operating fleet is now 5.3 years.

Taking into account the planned returns and further acquisition of aircraft, the Group plans to increase its fleet to 80 aircraft by the end of 2028, with Air Astana operating 46 aircraft and FlyArystan operating 34 aircraft. To achieve this goal, an additional delivery of 48 aircraft is required from 2024 to 2028, for which 22 operational lease agreements have already been concluded by 2026: 19 Airbus aircraft (11 A320neo and eight A321neo) and three Boeing 787-9 Dreamliners.

Maintenance and repair

The Department of Engineering Provision and Technical Maintenance (EPTM) of Air Astana has approximately 900 employees who work at the airports in Almaty and Astana, as well as at the line maintenance stations in Atyrau, Aktobe, and Shymkent. The EPTM Department is responsible for all maintenance work, technical services, aircraft acceptance/return, support for repair shops, sales of engineering consulting services, and cabin cleaning for the entire Air Astana aircraft fleet. It also prepares engineering and technical specialists (FlyArystan delegates all its engineering support and maintenance work to Air Astana).

The EPTM Department holds an AAK certificate and an EASA Part 145 certificate, which authorize it to perform line and base maintenance of its aircraft. Based on other certificates from the National Aviation Administration and an approved EASA Part 145 certificate, Air Astana also provides maintenance services to more than 22 other international and domestic airlines, including Asiana, DHL, Air Arabia, VietJet, Jazeera Airways, Lufthansa, Qatar Airways, Wizz Air, Fly Dubai, Air China, and Turkish Airlines, as well as Qazaq Air and SCAT Airlines. Additionally, the Training Academy conducts maintenance training on Airbus A320 family aircraft with various engine configurations in the Air Astana and FlyArystan fleets in accordance with the approved EASA Part 147 certificate.

The simplification of the Group’s aircraft fleet has created opportunities for efficient planned and unplanned maintenance without the need for external contractors. Since 2019, Air Astana has become the first airline in Kazakhstan capable of independently performing complex maintenance on the Airbus A320 family of aircraft, such as C1-check and C2-check, at its engineering bases in Almaty and Astana. After successfully completing the first six-year C-check maintenance at the end of 2023, Air Astana performs all C-checks on Airbus A320 family aircraft, including those owned by FlyArystan. The six-year maintenance is very complex: it took over 20 days and required 7,800 man-hours of work by highly qualified mechanics and engineers with international EASA Part 66 certificates and licenses, including specialists trained through the Air Astana aviation technicians' training program. The airline was authorized to perform this type of work at the beginning of 2023 following an international EASA audit. According to the Group's estimates, the ability to conduct C-check maintenance in-house is expected to lead to annual savings of approximately USD 3.0 million and has already reduced aircraft ground time by 14-18%.

The Group plans to expand its maintenance capabilities in line with the expected expansion of its aircraft fleet. This will require enlarging the existing hangar at the Astana airport and constructing a larger hangar at the Almaty airport to simultaneously accommodate two Boeing 787s or five Airbus A320s. As the Group gains experience in conducting C-check maintenance, it intends to offer C-check inspections to other aircraft operators by 2025.

Air Astana Training Academy

The Air Astana Training Academy, located in Almaty, was established with the aim of creating a center of expertise dedicated to training Group personnel, developing operational and personal skills of employees, and providing services to external customers from the aviation industry in CIS countries. It is the only training center in Kazakhstan certified under EASA Part 147, where both theoretical and practical training according to Part 147/145 standards is conducted, in collaboration with the Flight Training Center (see below). The Training Academy ensures all aspects of operational training:

- The Training Academy offers approximately 79 programs in engineering support, ground handling, and onboard services based on international standards (ICAO, IATA, and EASA 147/145), accredited by AAK and thus also available to external organizations.

- The new Flight Training Center, located at the Astana airport, was commissioned in 2023 and enables training on the L3 Harris Reality Seven A320 full-flight simulator. It is the first of its kind in Kazakhstan and is designed for 7,000 hours of training per year, which, according to the Group’s estimates, will reduce pilot travel time to external training centers by about 25%, equating to more than 1,000 person-days. Procedural training is also conducted on Aerosim fixed-base simulators, supported by the flight simulator. The Group plans to acquire a second full-flight simulator in 2025.

- Advanced onboard safety training at the Training Academy means that the Group will not engage external providers for initial or triennial crew training for its Airbus fleet. It is estimated that using the emergency cabin escape simulator provided by Skyart and the realistic fire training simulator provided by Flame Aviation for the A320 family of aircraft instead of sending pilots and crew members to Germany and Turkey for training will provide significant savings. The Group also intends to offer safety and emergency response training to other airlines in Kazakhstan in the future.

- A regular internal leadership course for captains, "Leadership for Flight Commanders", launched in 2020 as part of the "Learning/Career Options" program for the pilot community, is conducted for new captains.

- Since 2008, the Group has been running the Pilot Ab-Initio Cadet program to meet the demand for local qualified pilots. Each year, about 20 cadets start training under the program, and since its inception, 270 cadets have completed the training, with many becoming flight crew members, and some achieving the rank of captain. In 2024, the number of cadets recruited annually will be increased to meet the ongoing need for qualified pilots.

- All crew members undergo training, including safety techniques and emergency actions, first aid, and handling of hazardous materials. The Training Academy also conducts refresher training for crew members transitioning to business class or other positions within the Company.

- After completing two programs for obtaining EASA Part 66 licensed qualifications for apprentice mechanics from 2018 to 2022, in August 2023, the Training Academy also introduced a professional training program. New participants undergo a five-year course and receive international and local certificates, as well as the additional opportunity to obtain a licensed EASA B1/B2 qualification. Engineers responsible for aircraft airworthiness in the Group’s Technical Standards Department provide mentoring on standards compliance and coordinate training under the EASA Part 147 program.

Major IT investments and digitalization

Air Astana sees itself as one of the leaders in digital technology among airlines in the Central Asia and Caucasus region. The Group operates its own Airline Performance Excellence (APEX) program, which provides the Company with unrestricted access to information and helps model scenarios, especially during periods of rapid change. Several budget management and forecasting modules have been launched to handle fixed and variable costs, staffing, operational expenses, and to automate procurement planning through inventory control systems and accumulated stock management. The next stage of continuous improvement and a full part of the Group's strategic planning process involves expanding the forecasting capabilities within these modules.

The Group is also investing in a new online booking system aimed at increasing the visitor return rate to the website and conversion in e-commerce, as well as improving the overall quality of digital services by enhancing performance and a more modern, user-friendly interface. The system's capabilities will be expanded with the following enhancements:

- Convenient features that allow website users to find the nearest airport, select "low fare days", and store passenger and credit card data. This will simplify and speed up the booking process and help strengthen customer loyalty.

- Improvements will be made to the Nomad loyalty program that will facilitate user registration in the loyalty program and simplify the use of accumulated points.

- A wider selection of ancillary products will be displayed during the booking process to encourage more active use of these high-profit additional services.

Sustainability

Air Astana aims to become the leading environmentally sustainable and socially responsible airline in the CIS and Central Asia. Air Astana is committed to reducing its negative impact on the environment and the communities in which it operates, implementing a comprehensive approach to sustainable development. These efforts include reducing emissions, waste management, the efficient use of resources (such as energy) and supporting local communities.

ESG Strategy

In February 2023, the Group approved a comprehensive ESG Strategy for 2023–2032. It was developed based on best practices and international standards, considers steps already taken or planned by the Group in sustainable development, and is aligned with the United Nations Sustainable Development Goals (SDGs). The Group identified six priority SDGs: Quality Education (SDG 4), Gender Equality (SDG 5), Decent Work and Economic Growth (SDG 8), Reduced Inequality (SDG 10), Climate Action (SDG 13), and Partnerships for the Goals (SDG 17).

Specifying SDGs as priorities allowed the Company to develop an ESG Strategy that is not only more targeted but also more effective, reflecting the specific challenges and opportunities of the civil aviation sector. While we focus particularly on these six SDGs, we do not overlook the other goals. All 17 SDGs are necessary for a sustainable future and deserve our attention. Nevertheless, given the complex specifics of the industry, we have made a strategic choice to direct our efforts towards achieving those SDGs that are most closely related to our core activities, our capabilities, and where we can make a significant impact.

Delivery of seven A320neo family aircraft increasing the fleet to

56

units

Number of cadets joining the Ab-initio pilot training program each year

40

cadets

Low-carbon development program

To set targets for reducing greenhouse gas emissions, the Group has developed a Low Carbon Development Program (LCDP) for 2023-2032. It is part of the Group's ESG Strategy and is in line with Kazakhstan's goal of achieving carbon neutrality by 2060.

Under this program, the Group is replacing Airbus family aircraft with new generation A320 and A321neo aircraft. Airbus notes that this family of aircraft can provide up to 20% reduction in fuel consumption, 20% reduction in CO2 (NOx) emissions and 50% reduction in noise levels compared to the previous generation A320ceo family of aircraft. In recent years, the Group has made extensive efforts to reduce CO2 emissions, reducing CO2 emissions from 0.122 tons per passenger-kilometer performed in 2016 to 0.076 tons in 2023. The achieved emission reduction of 38% wins against comparable emissions for comparable international air carriers and low-cost carriers.

The Group is currently aiming to achieve zero emissions by 2060. However, during 2024, the Group plans to review its LCDP and update its commitment to achieve carbon neutrality by 2050 in line with the long-term goal adopted by the International Civil Aviation Organization (ICAO) by developing a sustainability roadmap with realistic short-term targets for the next five years. These will be independently verified by a third party as science-based targets (SBTi) consistent with the Paris Agreement's mitigation goals.

In line with the recent resolution of the Asia Pacific Airlines Association, the Group has also set a target to achieve a collective blending rate of 5% of sustainable aviation fuel with conventional fuel by 2030 (assuming SAF is available in the market). This target may be adjusted, if necessary, following the update of the LCDP.

Plans for 2024:

- Air Astana's IPOs on the London Stock Exchange, AIFC and Kazakhstan Stock Exchange attracted new Kazakhstani and international investment, which will help realize our ambitious business development plans from 2024 to 2028.

- Delivery of seven A320neo family aircraft (4 for FlyArystan and 3 for Air Astana), increasing the fleet to 56 units, in line with plans to increase the fleet to 80 units by 2028.

- Expansion of the route network by opening flights to Kuala Lumpur (Malaysia) in 2024. Flights to Japan and Singapore are planned for 2025-2026.

- Training volume on the L3 Harris A320 flight simulator is expected to increase to 5,500-6,000 hours. The simulator has a maximum annual capacity of 7,000 hours. The Group plans to purchase a second simulator in 2025.

- Each year, about 40 cadets join the Ab-initio pilot training program, which was established to meet the need for locally qualified pilots. A total of 270 cadets have already graduated and enrollment is expected to increase to 300 in 2024.

- Eight Airbus family aircraft are subject to maintenance, three of which require a full six-year C-check maintenance program, and the first 12-year C-check maintenance program is planned. In-house C-check maintenance has already reduced downtime by approximately 14-18%. By 2025, the Group intends to offer this type of maintenance to other aircraft operators.

- In July 2023, Pratt & Whitney announced an engine recall due to contamination of the material used in engine production. Air Astana has already addressed a number of issues related to this situation and has taken mitigating actions ahead of the market. During 2024, 34 engines are scheduled for removal and alternative engine replacement options are already in place to avoid schedule disruptions. The Company is in the final stages of negotiating an agreement with Pratt & Whitney that provides compensation and other support to the Company for operational impacts.

- The Group plans to refresh its low carbon development program and commit to zero emissions by 2050 through a sustainability plan and achievable short-term targets for the next five years.

- Investment in a new online booking system designed to increase repeat website visits and e-commerce conversion rates and improve the overall quality of digital service delivery.