The Fund's credit ratings

Obtaining ratings from leading international rating agencies represents an independent and sound assessment of the Fund's creditworthiness.

The agencies have access to all necessary information for a thorough assessment. They also emphasize the significant role of the Fund in the economy of Kazakhstan, which is aimed at industrialization and financial stability.

On November 6, 2023, S&P Global Ratings affirmed the “stable” outlook on the Fund's rating and affirmed the Fund's long-term and short-term ratings at “BBB-/A-3” and the Kazakhstan national scale rating of “KZAAA”.

On November 9, 2023, Moody's affirmed the rating of Samruk-Kazyna JSC at the level of Baa2, the outlook — “positive”.

On November 21, 2023, Fitch affirmed the ratings of Samruk-Kazyna JSC at the level of “BBB”, outlook “stable”.

Rating agency 2023

ВВВ-/A-3

November 6

Stable outlook

Ваа2

November 9

Positive outlook

ВВВ

November 21

Stable outlook

The Fund's financial results are based on the 12 months ended December 31, 2023 and compared to the prior two years. The following table sets out financial information showing the consolidated performance of the Fund's group.

PERFORMANCE INDICATORS OF THE FUND GROUP

| Indicator | 2021 | 2022 5 | 2023 |

|---|---|---|---|

| Consolidated revenue, KZT billion (excluding state subsidies) | 11,710 | 14,815 | 15,434 |

| Assets, KZT billion | 30,310 | 33,631 | 36,926 |

| Equity capital, KZT billion | 17,173 | 19,793 | 21,737 |

| Consolidated net profit per shareholder, KZT billion | 1,629 | 1,927 | 1,698 |

| EBITDA (operating), KZT billion | 2,856 | 3,241 | 3,543 |

| EBITDA Margin (%) | 24.4 | 21.9 | 23.0 |

5 All financial figures for 2022 have been restated and derived from the consolidated financial statements for the year ended December 31, 2023.

Consolidated revenues for 2023 amounted to KZT 15.4 trillion, which is higher than in 2022 by KZT 0.6 trillion, or 4%. Most segments in 2023 show year-on-year revenue growth, namely: sales of crude oil (+KZT 29 billion), railway cargo transportation (+KZT 391 billion), sales of gas products (+KZT 92 billion), oil and gas transportation (+KZT 24 billion), air transportation (+KZT 57 billion), electricity complex (+KZT 106 billion), telecommunication services (+KZT 49 billion), oil processing (+KZT 44 billion), electricity transmission (+KZT 13 billion) and railway passenger transportation (+KZT 15 billion).

Consolidated revenues for 2023 amounted to

15.4

KZT trillion

As of December 31, 2023, the Fund's consolidated assets amounted to KZT 36.9 trillion, increasing by KZT 3.3 trillion or 9.8% compared to 2022. EBITDA (operating) and EBITDA margin for 2023 amounted to KZT 3,543 billion and 23% respectively, compared to KZT 3,241 billion and 21.9% in 2022. For 2023, the Fund paid taxes and payments to the budget of the Republic of Kazakhstan in the amount of KZT 1,708 billion. General and administrative expenses for 2023 amounted to KZT 526.4 billion.

the Fund paid taxes and payments to the budget of the Republic of Kazakhstan in the amount of

1,708

KZT billion

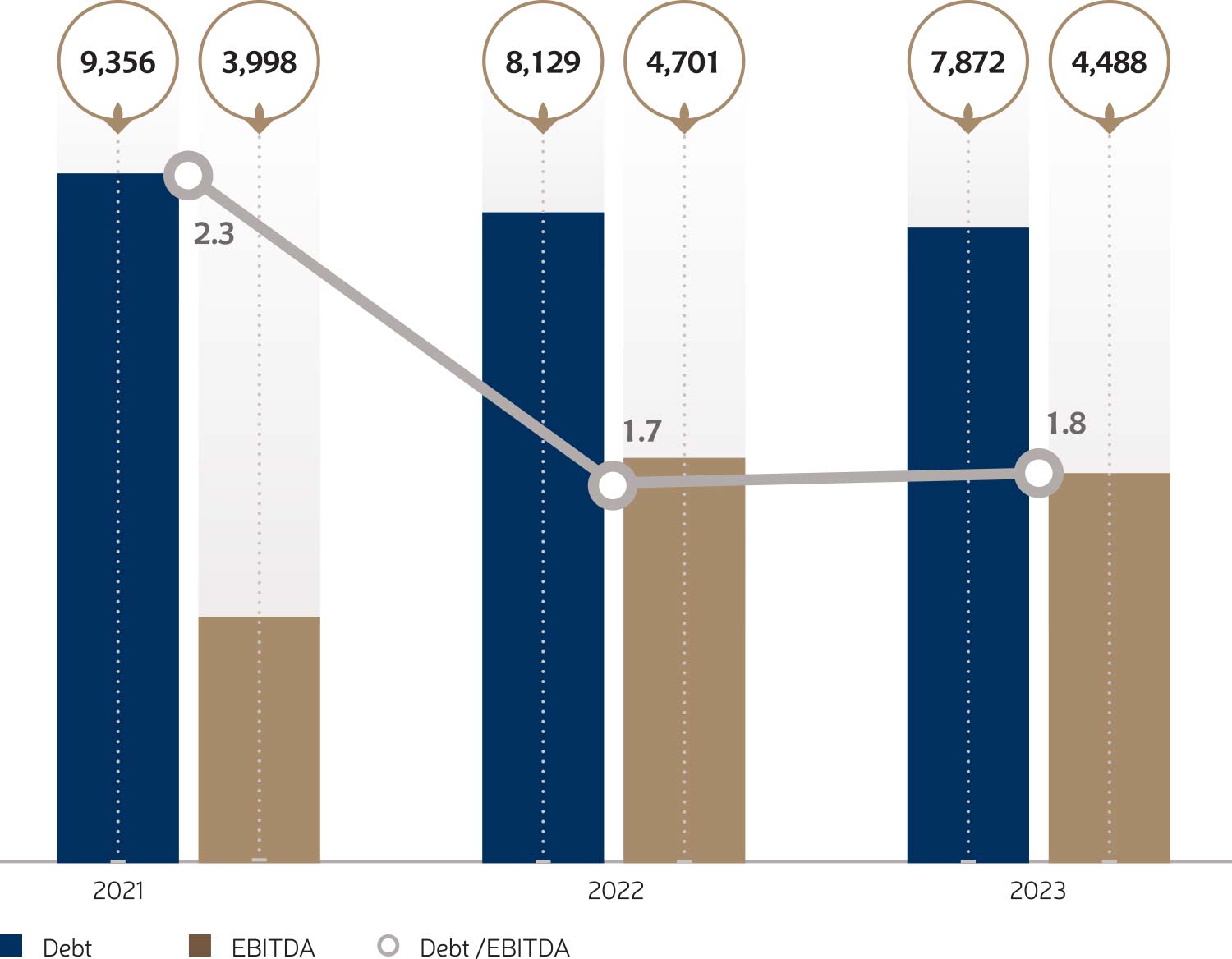

Debt and EBITDA of the Fund (consolidated)

At the end of 2023, the Debt/EBITDA ratio amounted to 1.75, which is due to the growth of EBITDA and reduction of debt. The decrease in consolidated debt to the level of KZT 7,872 billion resulted from the scheduled and early fulfillment of debt obligations by the Fund group.

At the end of 2023, the Debt/EBITDA ratio amounted to

1.75

Debt and EBITDA of the Fund (consolidated), KZT billion